How to Manage Risk in Your Stock Investment Portfolio

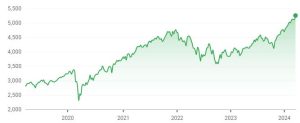

Investment risk management is an essential aspect of building and maintaining a successful stock investment portfolio, particularly in today’s market where the S&P 500 is at an all-time high. The higher the stock market rises the greater risk of a fall. Therefore Risk Management is becoming ever more important. This guide aims to walk beginners through the fundamentals of managing risk in their stock investments, covering key questions and strategies.

What is Investment Risk Management?

Investment risk management is the process of identifying, assessing, and addressing potential risks to minimize the impact on investment returns. It involves strategies that help investors protect their portfolio against the downside while still allowing for growth.

Why is Risk Management Important in Investing?

In the volatile world of stock investing, risk management is crucial. It helps investors to mitigate losses during downturns and capitalize on opportunities without exposing their portfolio to undue risk. Effective risk management can be the difference between achieving financial goals and suffering significant setbacks.

What Are the Different Types of Investment Risks?

Investors face various risks, including market risk, credit risk, liquidity risk, operational risk, and more. Market risk affects the entire market and can cause investment values to fluctuate. Credit risk involves the possibility of a company defaulting on its obligations, affecting the value of bonds and stocks. Liquidity risk arises when an asset cannot be sold quickly enough to prevent a loss.

How Can I Assess My Risk Tolerance?

Assessing risk tolerance involves considering your financial situation, investment goals, time horizon, and emotional capacity to handle market volatility. Tools and questionnaires can help you gauge your risk tolerance, but reflecting on past investment experiences is also insightful.

What Are Some Effective Risk Management Strategies?

Effective investment risk management strategies include diversification, asset allocation, hedging, and the implementation of stop-loss orders. Employing risk premia strategies and focusing on diversification in risk management can also significantly mitigate potential losses.

How Does Diversification Help Manage Investment Risk?

Diversification risk management is about spreading investments across various asset classes, industries, and geographical regions to reduce the impact of a poor performance by any single investment. This diversification as a risk management strategy helps lower portfolio risk and volatility.

What Is the Role of Asset Allocation in Risk Management?

Asset allocation is the process of distributing investments among different asset categories, such as stocks, bonds, and cash. This form of risk-based asset allocation helps manage portfolio risk by aligning the investment mix with an individual’s goals, risk tolerance, and investment horizon.

Can Risk Management Guarantee No Investment Losses?

While risk management strategies aim to minimize losses, they cannot guarantee a complete absence of loss. The inherent uncertainties in the market mean that there’s always a potential for investments to decrease in value.

How Often Should I Review My Investment Risk Management Plan?

It’s recommended to review and adjust your investment risk management plan at least annually or after significant life events or economic shifts. This helps ensure that your strategy remains aligned with your changing goals and risk tolerance.

What Is Hedging, and How Does It Work in Managing Investment Risk?

Hedging involves using financial instruments, such as options and futures, to offset potential losses in investments. For example, if you own stocks and fear a market downturn, you might buy put options as a form of equity portfolio risk management. This strategy can protect against losses, acting as insurance for your portfolio.

Implementing the Guide

To start managing risk in your stock investment portfolio, begin by assessing your risk tolerance. Next, explore diversification risk management by spreading your investments across a variety of asset classes and sectors. Consider employing strategies like the Ray Dalio risk parity strategy, which focuses on balancing the risks and returns of different asset classes based on their volatility and correlation.

Incorporate asset allocation based on your risk assessment, and regularly review your portfolio to adjust your strategy as necessary. Investigate hedging options to protect against significant losses, especially in uncertain market conditions.

Understanding and implementing these investment risk management strategies can help you navigate today’s stock market with more confidence and control. Remember, managing risk is not about eliminating it but about making informed decisions that align with your investment goals and risk tolerance.

To learn more about Risk Management click this link http://website-89a6fb6b.pmm.tyi.mybluehost.me/course/learn-investing-risk-management/