Our Portfolio Performances January 2024

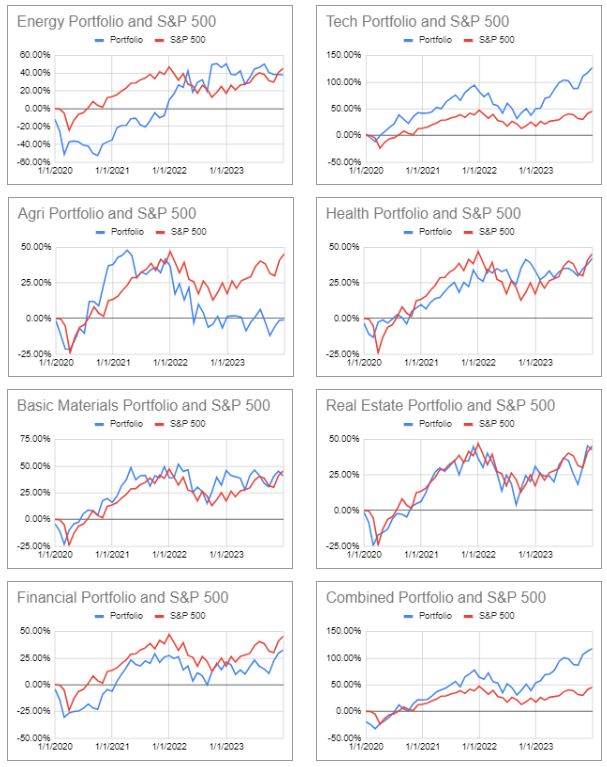

Here at Investingcourses.net we have a range of Investment Portfolios we use for teaching purposes. These are NOT about trying to out perform the S&P 500 which we use as a benchmark rather a live demonstration of how to build and execute portfolios that ties in with our investing courses. So whether we see a high or low performing portfolio it is important we understand why its is performing like this and apply that knowledge to your own portfolio construction.

All our portfolios are based on twenty stocks from the S&P 500 within a specific sector. The holdings are calculated by weighting the market cap of each of the twenty selected stocks and using a notional investment of $100,000 invested on January 1st 2020. This date is important as it includes the impact of the COVID pandemic which means every portfolio gets off to a poor start and has to recover. So we are really trying to test the resilience of these sectors to serious market shocks.

These are our Sectoral Portfolios

|

Investment Portfolios – Performance

|

|||||

| Performance | 1 Month | 6 months | 1 year | 2 years | All Time |

| Energy Portfolio | -0.54 | -7.04 | -12.50 | 28.09 | 37.94 |

| Technology Portfolio | 9.69 | 23.21 | 77.15 | 45.43 | 127.24 |

| Agriculture Portfolio | 0.17 | -2.42 | -2.46 | -37.81 | -1.00 |

| Health Portfolio | 4.35 | 7.31 | 8.85 | 13.80 | 42.38 |

| Real Estate Portfolio | -3.03 | 5.64 | 11.65 | 6.07 | 43.18 |

| Basic Materials | -4.48 | -5.36 | -4.88 | 1.91 | 40.97 |

| Financial Portfolio | 3.05 | 9.63 | 11.24 | 5.28 | 33.80 |

| Ultimate Portfolio | 5.33 | 17.96 | 66.20 | 55.47 | 122.31 |

Sectoral Portfolio Performance Comments

Energy Portfolio: The Energy Portfolio has faced a downturn in the short term, with a 0.54% decrease over the past month and a significant 7.04% drop over six months. However, its long-term performance remains strong, with notable growth over two years and all-time.

Technology Portfolio: Demonstrating remarkable growth, the Technology Portfolio leads with a substantial 9.69% increase this month, a 23.21% rise over six months, and an impressive 77.15% over the past year, showcasing its dominant position in long-term gains.

Agriculture Portfolio: The Agriculture Portfolio shows minimal movement in the short term but faces challenges in the long term with a significant 37.81% decline over two years, reflecting a struggling sector despite a slight all-time decrease.

Health Portfolio: With steady gains across all periods, the Health Portfolio shows resilience and growth, particularly over the past year. Its performance suggests a stable investment choice with moderate but consistent long-term growth.

Real Estate Portfolio: Despite a short-term dip of 3.03% this month, the Real Estate Portfolio has seen positive growth over the longer term, indicating recovery and potential for investors looking beyond immediate fluctuations.

Basic Materials Portfolio: This sector faces short-term challenges with a 4.48% decline this month, but its slight positive movement over two years suggests underlying resilience, despite a generally turbulent performance.

Financial Portfolio: Showing positive growth across all timeframes, the Financial Portfolio has rebounded well, particularly over the past six months, indicating a sector on the rise with a promising outlook.

Ultimate Portfolio: Outstanding in its performance, the Ultimate Portfolio boasts significant gains across all periods, especially over the past year, marking it as a premier choice for investors seeking high returns.

Overall Commentary

The January 2024 portfolio performance data offers a panoramic view of varied sectoral health and investment viability. Among the sectors, the Technology Portfolio and Ultimate Portfolio stand out with extraordinary performances, especially over the past year, marking them as the pinnacles of growth and investment allure. The Technology Portfolio, with a staggering 127.24% all-time growth, and the Ultimate Portfolio, with 122.31% all-time growth, underline the tech sector’s dominance and the strategic diversification of the Ultimate Portfolio as key drivers of their success.

Conversely, the Agriculture Portfolio presents a cautionary tale with a significant 37.81% decline over two years, showcasing the sector’s struggles and the impact of external variables on agricultural investments. Similarly, the Basic Materials and Real Estate sectors have faced their challenges, with short-term declines indicating potential volatility or sector-specific headwinds.

The Energy Portfolio, despite short-term losses, demonstrates resilience in the longer term, suggesting potential for recovery and growth for patient investors. Meanwhile, the Health and Financial Portfolios exhibit steady growth, affirming their status as stable sectors with consistent performance, making them attractive for those seeking moderate but reliable returns.

The varied performance across sectors highlights the importance of diversification and sector-specific trends. While technology continues to lead, the data suggests a broader narrative of recovery, challenges, and opportunities across the investment landscape. Investors would do well to consider these trends, aligning their strategies with long-term growth potentials and sector-specific dynamics, to navigate the complexities of the current economic environment effectively.

Best Portfolio Performance

Our highest Performing Investment Portfolio for January 2024 is our Technology Portfolio with a one month return of 9.69%.

The world of technology offers one of the most exhilarating landscapes for investment. But the tech sector isn’t just about joining the latest trend; it’s about understanding the intricate matrix of innovation, market forces, and global demand. The tech sector is a dynamic realm, encapsulating everything from software giants to semiconductor wizards, AI innovators to cloud computing marvels. Investing in this sector means understanding the myriad sub-sectors and identifying where future growth lies. It’s a dance between established tech giants and promising start-ups.

Our Portfolios delve into the construction, tracking and analysis of a portfolio and include the following sections:

- Portfolio Objective

- Portfolio Sector Outlook

- Portfolio Selection

- Company Profiles

- Holdings

- Performance

- Rebalancing Cycle

- Portfolio Analysis