The Week Ahead – March 4th 2024

The upcoming week in the financial markets is poised to be a pivotal one, with investors around the globe bracing for a whirlwind of economic indicators and central bank activities that could significantly influence market dynamics. In North America, the release of the Federal Open Market Committee (FOMC) minutes is highly anticipated, offering insights into the Federal Reserve’s monetary policy outlook. This, coupled with key inflation data from the US, could sway market sentiments as investors gauge the likelihood of future interest rate adjustments. Canadian markets are not to be overlooked, with inflation figures set to draw attention, potentially impacting the Bank of Canada’s monetary policy direction.

Across the pond, Europe’s financial landscape will be shaped by the release of Eurozone inflation data and Purchasing Managers’ Index (PMI) surveys, offering a glimpse into the region’s economic health. Additionally, the UK is set for a significant data release week, with inflation, employment readings, and Gross Domestic Product (GDP) figures expected to provide a comprehensive overview of the economic climate. The European Central Bank (ECB)’s contemplation on pausing its tightening cycle adds another layer of intrigue, influencing investor strategy.

Globally, the spotlight also turns to Asia-Pacific, with major data releases from China and monetary policy decisions from the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ). These events, alongside US retail sales figures, earnings reports, and central banker appearances, will contribute to a week filled with potential market-moving news.

Investors should brace for volatility, with inflation data and central bank rhetoric at the forefront of market movements. The ongoing debate over the direction of monetary policy, amidst concerns over economic growth and inflation, suggests a week of cautious trading ahead. As the global economy navigates through these uncertain times, the importance of staying informed and agile in investment strategies cannot be overstated.

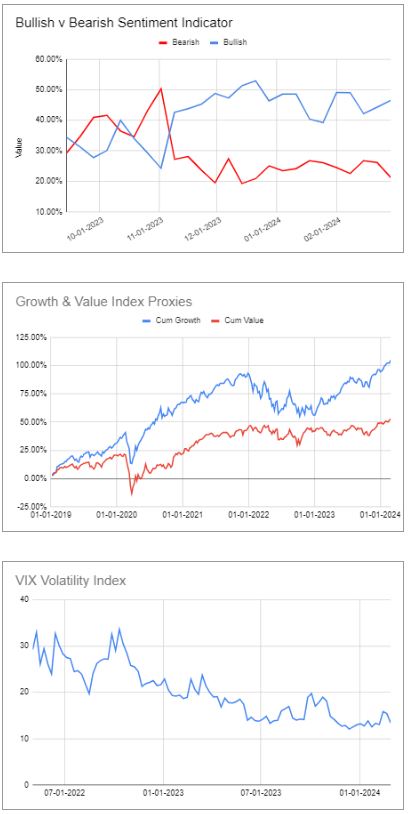

Bullish & Bearish Sentiment

The Bullish trend is continuing and getting somewhat stronger as the divide between bulls and bears has grown stronger in the last week. This situation can’t last forever.

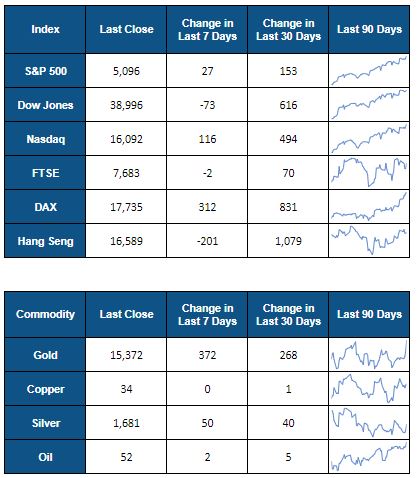

Growth & Value

The Growth sentiment is firmly established and out numbers value by a large degree.

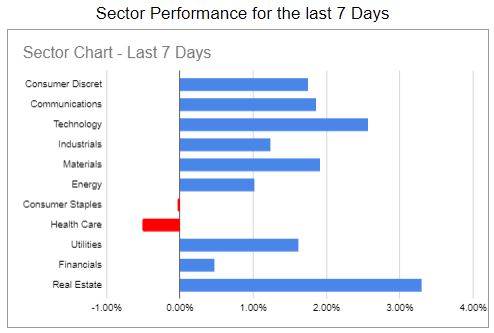

VIX Volatility

The VIX index is a measure of the volatility of the S&P 500. Volatility is driven by fear, so the more volatile the chart the more fear is in the market. We can see from this chart that volatility is low so fear is low which corresponds with our other two charts.

These three charts taken together provide a solid view of the mood and mindset of investors. They are even more greedy & confident compared to a week ago and continue to focus their “Buys” on growth stocks which given the non stop rise in growth stocks makes that position relatively risky. However investors are happy to put that risk aside and try to make money in this environment. Taking this perspective along with the high values of bitcoin and you can recognise a lot of exuberance in the market.

Economic Calendar for the week ahead

| Date | Event | Previous | Estimate |

| 03-15-2024 | Michigan Consumer Sentiment (Mar) | 76.9 | |

| 03-14-2024 | Retail Sales MoM (Feb) | -0.8 | 0.2 |

| 03-14-2024 | PPI MoM (Feb) | 0.3 | 0.2 |

| 03-12-2024 | Inflation Rate YoY (Feb) | 3.1 | 0.6 |

| 03-12-2024 | Core Inflation Rate YoY (Feb) | 3.9 | 0.3 |

| 03-08-2024 | Non Farm Payrolls (Feb) | 353 | 200 |

| 03-08-2024 | Unemployment Rate (Feb) | 3.7 | 3.7 |

| 03-07-2024 | Fed Chair Powell Testimony | 5.285 | 10 |

| 03-06-2024 | Fed Chair Powell Testimony | 0.4 | -0.1 |

| 03-05-2024 | ISM Services PMI (Feb) | 53.4 | 53 |

Stocks Reporting this Week

| Date | Stock | EPS Estimate | |

| 03-05-2024 | Target Corporation | 2.41 | |

| 03-05-2024 | Ross Stores Inc | 1.63 | |

| 03-06-2024 | Campbell Soup Company | 0.77 | |

| 03-06-2024 | Brown-Forman Corporation Class B | 5.43 | |

| 03-07-2024 | Costco Wholesale Corp | 3.6 | |

| 03-07-2024 | Archer Daniels Midland Company | 1.42 | |

| 03-07-2024 | The Kroger Co. | 1.13 | |

| 03-07-2024 | Broadcom Inc. | 10.25 |

A fall in the Dow and small rise in S&P 500 suggests some tempering of the exuberance however this is in contrast to the sentiment charts above.

Given that the market is a more accurate reflection of some of the indicators it could be felt that this may be the start of the end of the recent very bullish run.

So investors beware that the market could be heading for a slowdown and might turn down, so its important to have your stop losses in place to lock in your gains and have your Risk Management plan also in place.